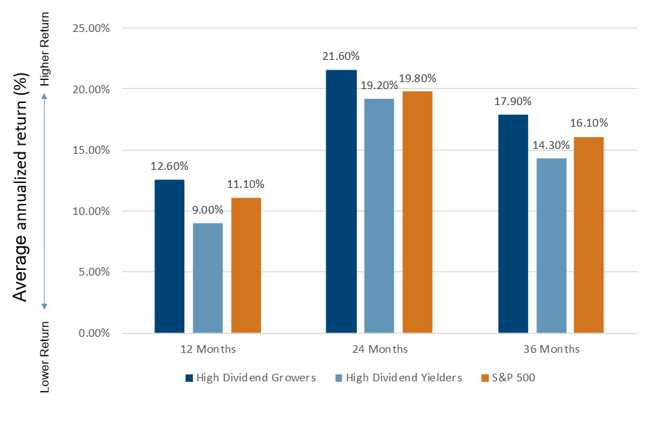

Dividend Growers Outperform in Low Rate Environments

Performance when more than 50% of the S&P 500 stocks have a yield greater than the 10 year treasury.

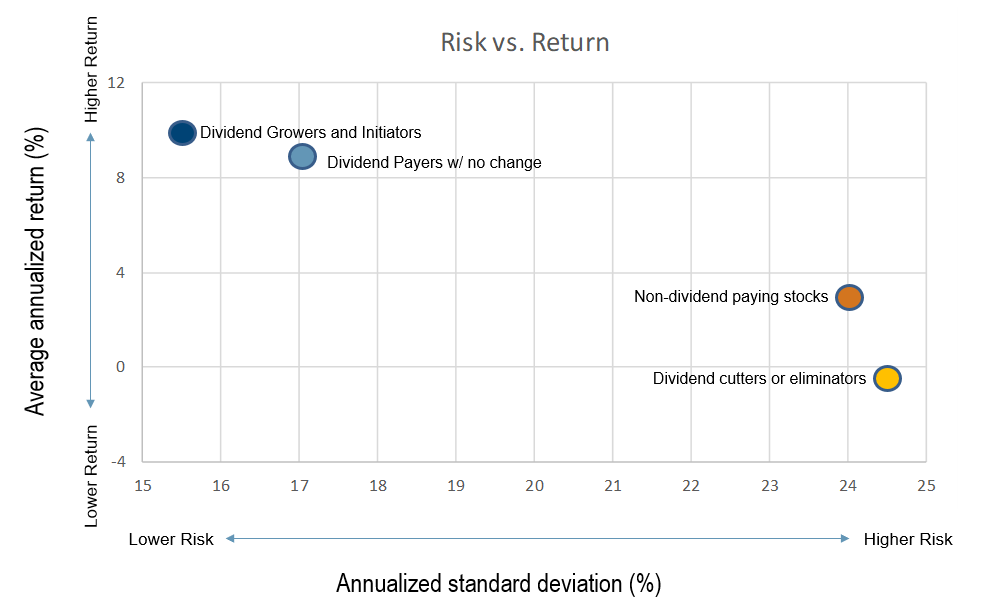

Dividend Growers Have Less Risk

Dividend Growers and Initiators outperform those who don't with less risk.

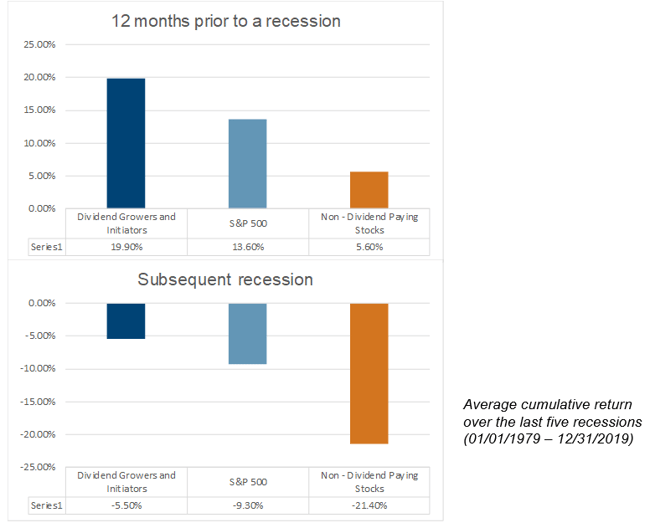

Dividend Growers Outperform Prior to and During a Recession

Dividend Growers provide the downside protection and limited volatility during market downturns.